Your Q3 2023 Deadlines for the Diary

The ATO lets us have a little extra time for December lodgements so we can enjoy the summer holiday period. But once you’re back in the swing of things after a break (or busy trading period), you’ll need to plan for deadlines, lodgements and payments.

Remember, Single Touch Payroll Phase 2 is now mandatory, although some software providers have extensions in place. If your payroll software is STP2 compliant, upgrade now if you haven’t already. If your payroll has grown in the last year, you may need to look at upgrading your payroll software – talk to us, and we can get you set up on a solution that is better suited to your business.

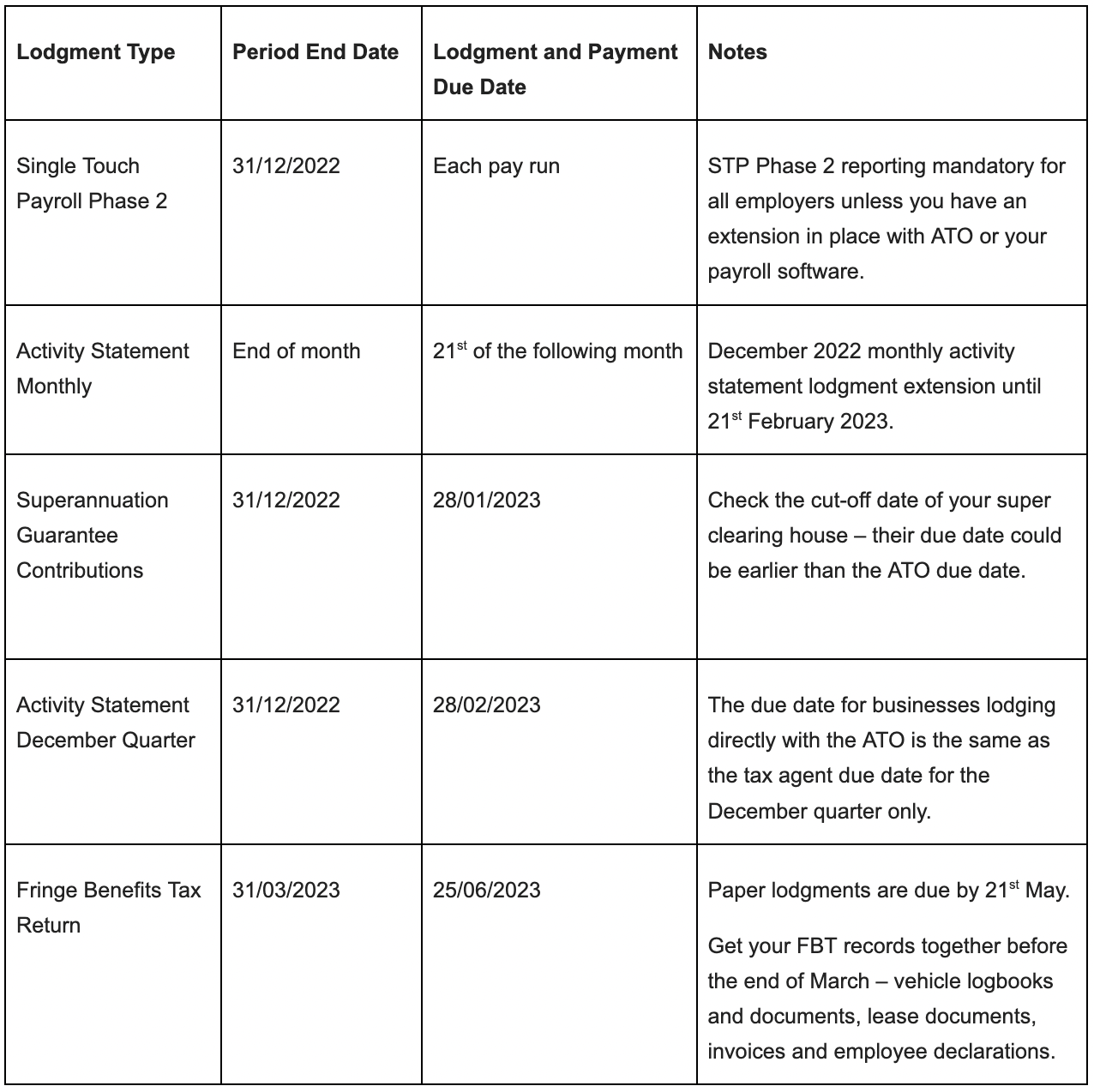

We’ve highlighted some upcoming business lodgment due dates to help you get organised for January to March, the third quarter of the 2023 financial year.